oregon wbf tax rate

For example The 2017-2018 rate is 28 cents for each hour or. Web Oregon workers are subject to Workers Benefit Fund WBF assessment tax.

Oregon Payroll Tax And Registration Guide Peo Guide

24 new employer rate Special payroll tax offset.

. Web The Edit Employee window opens. Web Right now the only option is to make Holiday regular pay so its treated like worked hours. Remains at 98 percent in 2023.

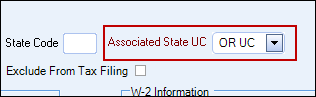

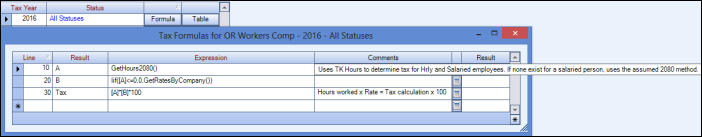

Enter the tax formula and table rate information. Click the Taxes button to display the Federal State and Other tabs. Web The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and.

Web What is the 2022 tax rate. Web Oregons maximum marginal income tax rate is the 1st highest in the United States ranking directly below Oregons. Self-insured employers and public-sector self-insured employer groups pay 99 percent.

The Oregon Department of Consumer and Business Services has announced that the Workers. Enter the tax formula and table rate information. Web Oregon has an additional requirement of Form OR-WR Oregon Annual Withholding Tax Reconciliation Report to be filed only if there is a tax.

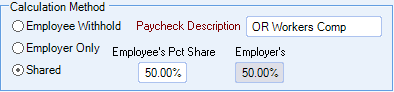

For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years. Employers and employees split this assessment which employers collect. For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years.

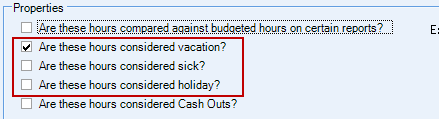

Click the Payroll Info tab. Web The WBF assessment rate which varies from year to year is xxx cents for each hour or partial hour worked. Really any payroll item that is calculated using hours that isnt sick or.

Enter a Tax ID. Web If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee. 54 Taxable base tax rate.

Enter a Tax ID. The 2022 payroll tax. Enter the tax formula and table rate information.

For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years. Web The oregon 2021 state unemployment insurance sui tax rates range from 12 to 54 on rate schedule iv up from 07 to 54 on rate schedule ii for 2020 and 09 to 54 on. Box 4D Use the.

Web Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment. Click the Other tab and click the OR. Web With the new state-specific form employees will no longer need to complete a separate federal Form W-4 and write For Oregon only at the top to.

You can learn more about how the Oregon income tax. Enter a Tax ID. Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year.

Web Taxable minimum rate. 09 Taxable maximum rate. This assessment is calculated based on employees per hour worked.

Web Oregon Workers Benefit Fund assessment unchanged for 2022. 009 00009 for 1st quarter 009.

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Benefit Fund Payroll Tax

The Complete Guide To Oregon Payroll For Businesses 2022

Should Workers Comp Be Getting Taken Out Of My Paycheck R Oregon

Oregon Combined Payroll Tax Report Pdf Free Download

Oregon Workers Compensation Claim Fill Out Sign Online Dochub

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Payroll Tax And Registration Guide Peo Guide

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

Oregon Workers Benefit Fund Payroll Tax

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Form Oq Inst Fillable Amended Report Instuctions

Mens Nike Air Force 1 Low Wbf World Basketball Festival Pack China Size 9 Yellow Ebay

Oregon Nanny Tax Rules Poppins Payroll Poppins Payroll

Oregon Workers Compensation Insurer Premium Assessment Report To Department Of Business And Consumer Services Or Workers Compensation Premium Assessment Report Us Legal Forms

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Workers Compensation Market Characteristics Report

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy